1099 Employee Contract Template

Step 4 Write Employers Information. The employer can include supporting documents with this letter keep in mind that there are state and local laws regarding salary disclosure and some require employee authorization.

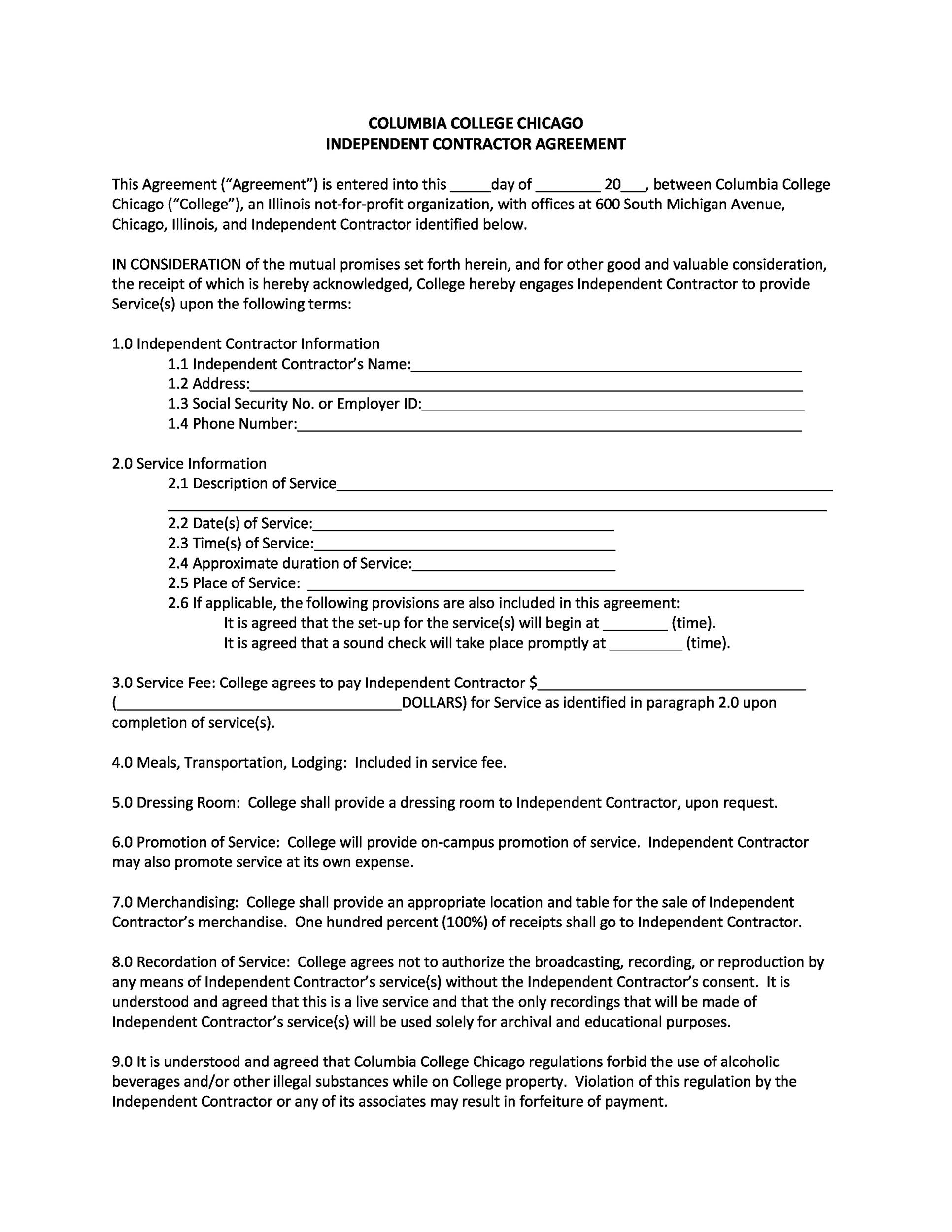

Free Independent Contractor Agreement Template 1099 Word Pdf Eforms

Employing them saves you the stress of drafting one from scratch.

. This free pay stub template will assist you when it comes to keeping track of your payments with your employees especially since the time for payroll can be quite a hassle. This category is only for contractors so expenses like lawyer fees or employee wages would go elsewhere. Identify the total amount of each expense type by using the filter option on.

The confidential information is defined in the agreement which includes but not limited to proprietary information trade secrets and any other details which may include personal information or events. An employee contract details the legal rights and obligations of the employee. Employment taxes can be deducted as well on Line 23 - Taxes and Licenses.

Find the collection of the most commonly used forms for the construction industry. Theres no such thing as a 1099 employee You are either an employee or you are not. Save time and increase employee productivity by giving them access to the largest library of the most widely used HR forms.

When youre a 1099 employee that means you basically work for yourself. E-sign forms with a legally-binding e-signature. This is the employer.

Type keywords in the Search field and fill out each template online. There are 6 basic steps to using this 1099 Template. Instructions and Help about mobile home sales contract template form.

Employee Wages Line 26 If you have employees you can deduct their wages commissions and bonuses simple as that. Enter all expenses on the All Business Expenses tab of the free template. Write Full Employer Details.

Diversity Equity Inclusion. My Account Log out. The IRS rules are here Independent Contractor Self Employed or Employee and ICE uses a similar process to determine who.

When youre a W-2 employee you work for someone else. Whether youre looking to apply for a new position onboard a new hire set up employee contracts or outline the governing structure for LLC you can gain access to. Filing Taxes Form 1099-MISC IRS Form 1099-MISC is required to be completed by the contractor if there were payments made to the subcontractor in excess of 600 during the fiscal year.

This section provides the employees salary and bonus if any. Recruitment review termination vacation compensation and many more. You can find instructions regarding this legal requirement on the IRSs website.

How to Use this 1099 Template. A construction contract may be a legally binding agreement between parties. Freelance workers cannot have employees but they can delegate work to other independent contractors.

DA-6P - Paycheck Stop Payment Request. The advanced tools of the editor will direct you through the editable PDF template. Employee Benefits Programs Line 14.

Edit and fill in the pre-set fields of the template and make it uniquely yours. A 1099 form marks self-employment earnings for the IRS. Why does this matter.

For State Employees Civil Service Board. Consent Digital Signature Gym Membership Contract Template Consent Digital Signature Annual Report Template Domestic For Profit. Download a PDF or Word Template.

A pay stub is a temporary document that is related with that of the paycheck of the employee. Get material schedules employee evaluations and weekly equipment usage sheets. When you find a needed form you can download or export it right from your.

Then print share or send them for signing right from the editor. Do you need to fill I-9 form for 1099 contract. Small Business Legal Forms.

The contractor will be required to provide this form to the subcontractor by January 31 of the following year and file with the IRS by the last day of February. To that extent an employee must be consulted if an employer changes the terms of the contract. Non-Disclosure Agreement NDA Template Sample.

DA-115P - Agency Authorized Signatures Payroll. The employer is responsible for a lot of the cost of employing someone. Get material schedules employee evaluations and weekly equipment usage sheets.

Non-disclosure agreements are legal contracts that prohibit someone from sharing information deemed confidential. 2022 W4 - Employees Withholding Certificate Provided by the IRS. Free Pay Stub Template for Excel 2007 - 2016.

In the US there are basically two types of employment. A receipt template is a document that you can change to suit your needs. Find the collection of the most commonly used forms for the construction industry.

If a freelance worker earns more than 600 from a company they will receive a 1099 form. If the Recipient will issue a W-2 to the Caregiver and fulfill an Employers obligations in this capacity then mark the checkbox labeled W-9 Employee Please note that if the Caretaker is a W-9 Employee you must fill out the page labeled Exhibit A which must be signed by both parties upon completion. This means that your receipt can be personalized to meet the look and feel of your business.

Free Independent Contractor Agreement Free To Print Save Download

Free Independent Contractor Agreement Template 1099 Word Pdf Eforms

Independent Contractor Agreement Template Legal Templates

50 Free Independent Contractor Agreement Forms Templates

Free Independent Contractor Agreement Template 1099 Word Pdf Eforms

Free Independent Contractor Agreement Template 1099 Word Pdf Eforms

50 Free Independent Contractor Agreement Forms Templates

Comments

Post a Comment